LONDON — The offices of TransferWise are standard-issue start-up funk. Large, open-plan work space. Ping-pong table and grub-filled kitchen. Even a sauna, a nod to its Estonian founders.

But there’s little playing around going on here. Instead of fiddling with a mobile game or an e-commerce idea, the 3-year-old company is set on disrupting nothing less than banking’s dominance of the money-transferring business by charging less and offering transparency to users.

“Banks are an interesting species,” says co-founder Taavet Hinrikus, 33, who made his tech bones as the first employee hired by Skype. “They’re outdated in how they deal with consumers. Think about all the revolutions going on in everything from aviation to music, but not in banking. We are different.”

Veteran entrepreneurs-turned-investors agree. The latest chunks of TransferWise‘s $33 million in funding were provided by maverick businessman Richard Branson and PayPal co-founder Peter Thiel, in what is the first European investment of his San Francisco-based Valar Ventures.

The company has 112 employees, a third here in the East London hub known as Silicon Roundabout and the rest in the tech-savvy Estonian capital of Tallinn.

Helping justify its reputation as one of this city’s hottest stars in financial tech — or fintech — is news from TransferWise that so far it has shuttled $1.6 billion worth of currency around the world, saving consumers $75 million in bank fees.

Growth potential for TransferWise arguably is huge. An estimated $5 trillion to $10 trillion is sent internationally each year, “and that’s just counting consumers and small- to medium-sized companies, not corporations,” says Hinrikus. “Our share is therefore very small still, but we’re growing at 20% a month.”

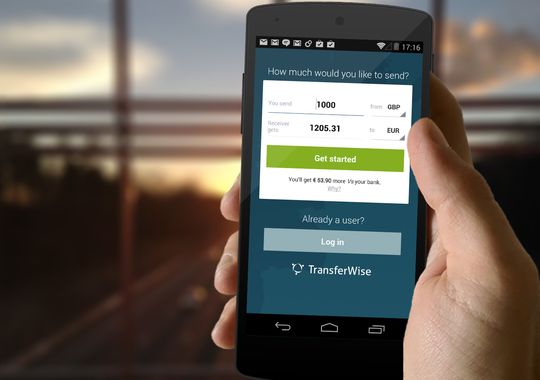

The company charges a flat half-percent transfer fee, or $5 to send $1,000, and notably uses Reuters-published exchange rates. Banks often charge fees to send money and often use slightly less favorable exchange rates.

For everyone from students to freelancers to small companies, these savings can prove significant as they send modest sums of British pounds, Hungarian forint, Indian rupees or a dozen other currencies. At present, TransferWise provides the ability to send money to the U.S. but not out.

“The U.S. is a huge market for us, and we are working on the various regulations to make sure that happens soon,” says Hinrikus, who is in charge of the company’s marketing strategy, while his friend, co-founder and former management consultant Kristo Käärmann, 34, heads operations.

HOW IT WORKS

To simplify how it works: TransferWise keeps track of a rolling network of money transfers, matching them so that funds never actually leave their respective countries. Transactions are initiated by inputting bank or debit card information on the site or its mobile app.

But a better explanation comes from the company’s origins story.

Some years back, both friends lived and worked in London. Hinrikus was paid in euros by Estonia’s Skype. Käärmann was paid in British pounds, but had a mortgage to pay in euros back in Estonia. Both were tired of paying high bank fees for each monthly transaction.

Their solution: Every month, Käärmann put pounds in his friend’s British bank account, while Hinrikus put euros in his buddy’s Estonian account. No bank fees; bills paid.

“We had a feeling that we weren’t the only people who could benefit from this arrangement,” says Hinrikus. “We launched TransferWise, and in 15 minutes, someone agreed to transfer a thousand British pounds. That told us something.”

While the appeal is apparent to some, others take convincing. TransferWise consumer marketing chief Joe Cross says consumers call and e-mail the company “to see if we’re legit. Many tell us, ‘But my bank says the transfer is free,’ so we have to caution them about hidden fees or inflated exchange rates.”

Branding will get a boost when some of the company’s latest millions get funneled into advertising buys. Says Cross: “Banks in general these days have a massive trust issue after the scandals of past years, so we think by being really transparent about our services there’s a chance to transfer the power to consumers.”

Hurdles for TransferWise could include countries with less than stable economies and currencies, as well as keeping liquidity high in each country, says Wayne Wong, a fintech analyst with Venture Scanner. “It’s fitting that a tech start-up is disrupting this sector.”

Should banks be worried? “Yes and no,” says Wong. “Yes, because TransferWise provides real value to the consumer. No, in that banks and companies such as Western Union have huge networks of physical branches that are helpful for people without Internet connections. So TransferWise might not be for everyone.”

The concept instantly appealed to Stowe Boyd, lead analyst at Gigaom Research. After doing a short consulting call with a European company, he was faced with the challenge of getting his $170 fee without giving up 20% to various bank charges.

“You could say $30 isn’t a big amount, but it’s the principle here that we’re talking about,” says Boyd, who in a recent online essay about TransferWise likened the system to a tech version of the ancient Islamic Hawala method of transferring funds using a street-level network of brokers. “This is simply an industry ready for change.”

Hinrikus used to repeat a saying that for a while found its way onto the TransferWise website: “Bye-bye banks.” It was taken down after it led to more questions than answers from consumers. But his one-sentence pitch these days is easy to decipher.

“Today, sending money should be no harder than sending an e-mail,” he says. “With any luck, my experience with Skype can help us build and scale TransferWise globally.”

Not bad for an idea that blossomed from two friends just trying to pay their bills.